Types of credit

There are three main types of credit: instalment credit, revolving credit, and open credit. Each of these provide a different way for you to borrow and repay.

Instalment credit: This is where the money that is loaned to you is paid back in fixed instalments (which will include any interest charged) over an agreed time. Once all instalments have been paid, the account is considered closed. Some examples of instalment credit accounts are:

- Mortgages

- Personal loans

- Student loans

- Car loans

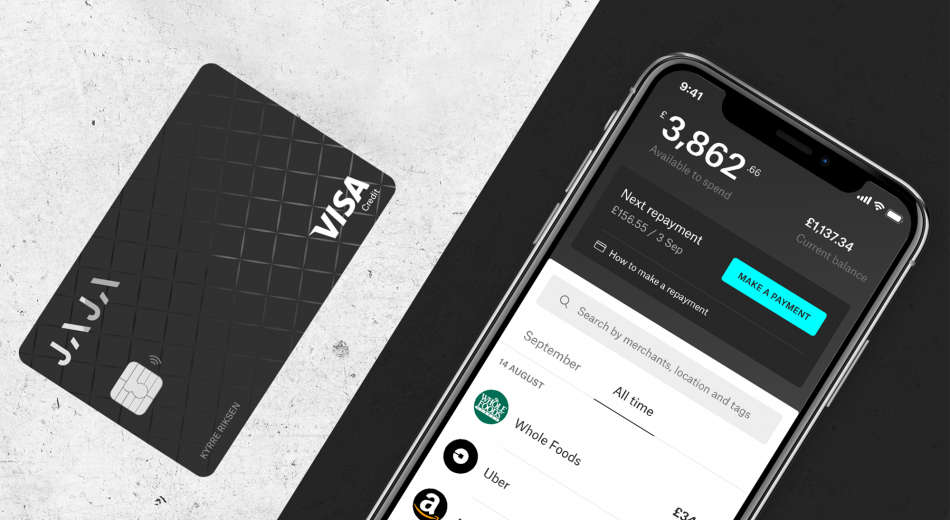

Revolving credit: This is where you can repeatedly borrow and repay amounts from a single line of credit as and when you need to. You can choose how much you borrow within your credit limit, and how you repay what you’ve spent. Interest may be charged if you don’t pay your balance in full by your statement due date. Your account will stay open until you decide to close it. Examples of revolving credit would be:

- Overdrafts

- Store cards

- Credit cards

Open credit: Open credit is unique because you must pay your balance in full each month, but your payments may vary. A good example of open credit would be your electricity bill; the amount you owe depends on how much electricity you used that month and you’re expected to pay it in a few days after receiving it. Many utility bills are open credit, like:

- Water bills

- Gas

- Phone service provider bills

Regardless of what types of credit you may choose to borrow, you must always borrow responsibly to avoid interest and late payment fees.