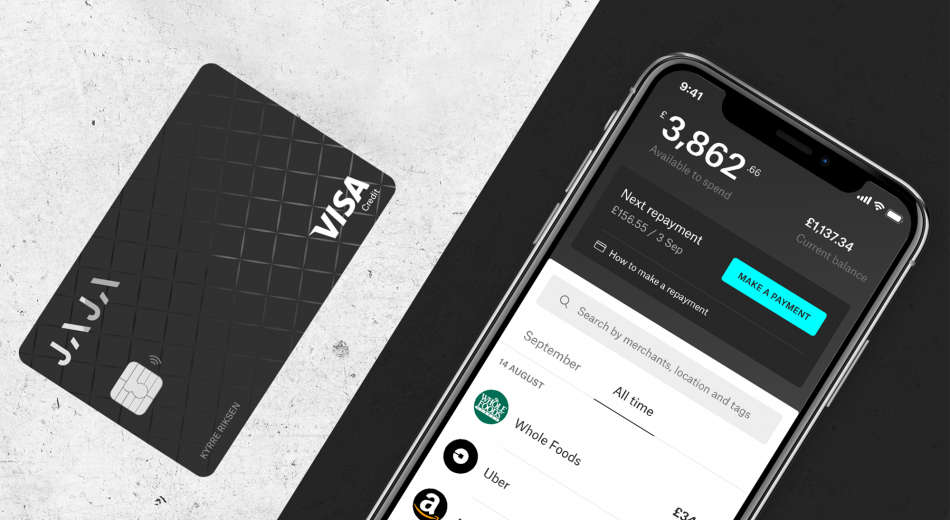

Boost your credit score and your Cashpot with the new credit builder card from Asda Money, powered by Jaja Finance

- Asda Money and Jaja Finance have launched a new credit builder card – the Asda Money Select Credit Card – that will reward customers when they shop in store or online

- Shoppers will earn unlimited 1% back on Asda purchases when they use their Asda Money Select Credit Card and 0.3% on non-Asda spend

- Asda Money Select Credit Card will help customers build their Asda Rewards Cashpot while building their credit score

London, 9th November 2022: Asda Money and Jaja Finance have today launched the Asda Money Select Credit Card, one of the few credit builder cards available in the UK that offers the same benefits as its mainstream card – the Asda Money Credit Card. The card is now available to customers with lower credit scores looking to improve their credit rating.

Shoppers using the new credit card will be rewarded with 1% of every £1 spent on Asda groceries, fuel, George, and other Asda services, with an additional 0.3% on all other purchases outside of Asda. Rewards will be earned as ‘Asda Pounds’ that customers can then transfer into their Asda Rewards Cashpots to use in-store or online.

The Asda Money Select Credit Card is priced at 34.9% representative APR with no annual fee and aims to offer long-term, good value credit. Customers looking to improve their credit rating can check their eligibility and see the credit limit and interest rate they could be offered without it affecting their credit rating.

Lucas Dalglish, Chief Commercial Officer at Jaja Finance said: “There are very few credit builder products on the market that offer consumers the opportunity to build their credit rating whilst benefitting from the same great rate of rewards available to other customers. Given the cost-of-living pressures on many households, we believe the Asda Money Select Credit Card will go a long way to rewarding customers for buying their everyday essentials.

“We’ve already seen an incredible response to our Asda Money Credit Card and we are confident that our credit builder card will prove equally as popular with Asda customers wishing to build their credit score.”

Katie Walley, Senior Director Asda Money & Mobile, said: “We are always looking for new ways to reward our customers and we hope that by giving Asda pounds back to Asda Money cardholders we can help them to improve their credit rating whilst still being able to purchase little extras with the rewards they receive for everyday purchases through the Asda rewards App.”

Customers can apply for the Asda Select Credit Card online at money.asda.com/credit-card/asda-money-select-credit-card/.

Notes to Editors

- Customers using the Asda Money Select Credit Card will receive Asda Pounds back into their Asda Rewards app when buying Asda products or services including food and drink, George clothing, fuel and other Asda services such as Asda Tyres and Opticians.

- Customers will not earn Rewards on Asda Travel Money, cash or cash alternatives. Terms and Conditions apply and can be found at money.asda.com/credit-cards.

About Jaja Finance

Jaja Finance Ltd is a fintech providing digitally led credit card products with a focus on simplicity, functionality, service and security. It is headquartered in London and regulated by the FCA and combines the technical and digital capabilities of a modern technology business with deep retail financial services and credit card sector experience.

Following its closed transaction of up to £120 million with new majority shareholders – KKR and TDR Capital – in March 2022, Jaja Finance signed a partnership deal with Asda to provide digital reward credit cards to its 18 million customers.

In June 2019, Jaja welcomed Bank of Ireland UK and AA Credit Card customers onto its new credit card platform in October 2020, transferring historical Post Office Credit Cards to new Jaja Credit Cards.

Media Contacts

Gabrielle O’Gara

Tel: 07818 240 343 / Email: press@jajafinance.com