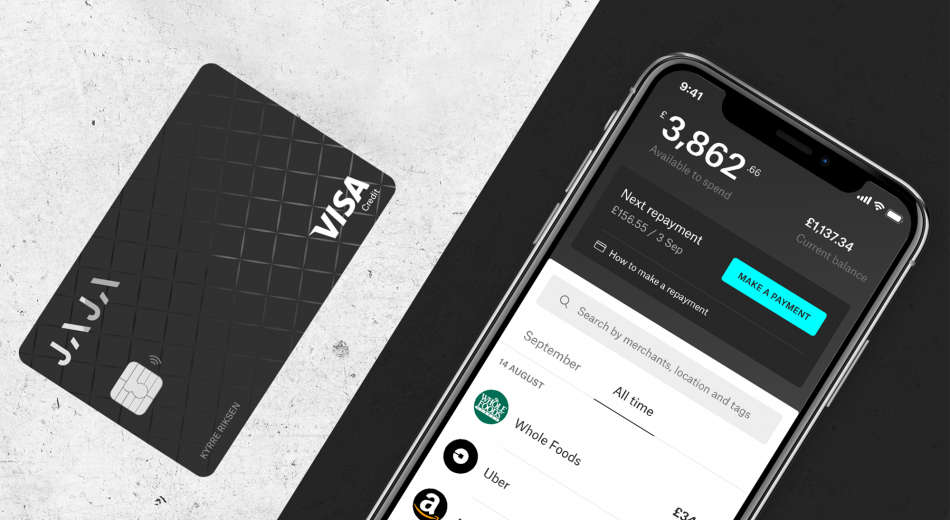

Jaja Finance reduces customer response times by 90% with GenAI chat assistant

- Jaja has reduced customer response times to fifteen seconds

- Airi has already had over 44,000 unique customer conversations

- Jaja’s advanced language model is already recognising customers with additional financial needs

London, 10 September 2024: As one of the first UK fintechs to launch a Generative Artificial Intelligence (GenAI) chat assistant using Anthropic’s state-of-the-art Claude 3 model family, Jaja Finance “Jaja” has today announced that it has reduced its customer service response times by 90% since launching ‘Airi’ three months ago. Initially predicted to reduce customer response times by 65%, the digital lender can now answer customer enquiries in just under fifteen seconds, versus the three minutes it took prior to launch.

Having already had over 44,000 unique customer conversations, Airi has independently resolved over 9,000 (20%) general enquiries. This means that Jaja customer service colleagues now have more time to spend with customers resolving more complex enquiries.

Available in the Jaja and Asda Money app, Airi is designed to enhance customer experience by providing a 24/7 service, offering increased intelligence with near-human levels of responsiveness and improved data accuracy. Jaja customers can use Airi to access a broad range of self-serve options with 24/7 availability, whether it is managing general statement enquiries or discussing payment options. By using Claude 3’s natural language and summarisation capabilities, Airi also allows customers to reply to conversations at their own convenience, while providing them with a full transcript of their conversation.

Dave Chan, CEO at Jaja Finance said; “Airi continues to massively exceed our expectations in terms of delivering the superior experience our customers expect. Our colleagues are also seeing the benefits of its advanced capabilities by being able to spend more time dealing with customers’ complex enquiries, but also by helping our customers use their credit better.

“This is only the start of our journey with GenAI and we have already made, and will continue to make, many more advancements by optimising its technical expertise, for both our customers and our colleagues.”

Since launch, Jaja has already extended the use of its GenAI model to customers who require additional financial support with their credit. Airi’s high performing foundation models (FMs) can now recognise more complex enquiries which are then redirected to its customer service team for interactions that require a more in-depth, human, conversation.

Airi uses Amazon Bedrock, a fully managed service from Amazon Web Services (AWS) that offers a choice of high-performing foundation models (FMs), to access Claude 3 models. The digital lender is using this advanced technology to achieve its commitment of helping customers use credit better by enhancing customer interactions and significantly reducing customer response times through its in-app customer messaging centre.

By building with Claude 3 models on Amazon Bedrock, Jaja is utilising the language model’s latest capabilities and providing customers with a superior experience while simultaneously reducing cost, increasing speed and enabling the fintech’s ambitious growth plans of becoming the UK’s leading digital lender. Jaja’s use of Claude 3 Sonnet further enhances the powerful AI and machine learning technologies already deployed within its customer management models, credit decisioning and affordability assessments.

Notes to editors

About Jaja Finance

Jaja Finance Ltd is a fintech providing digitally led credit card products with a focus on simplicity, functionality, service and security. It is headquartered in London and regulated by the FCA and combines the technical and digital capabilities of a modern technology business with deep retail financial services and credit card sector experience.

Following its closed transaction of up to £120 million with new majority shareholders – KKR and TDR Capital – in March 2022, Jaja Finance signed a partnership deal with Asda to provide digital reward credit cards to its 18 million customers, and subsequently launched the Asda Money Credit Card and Asda Money Select Credit Card. More recently, Jaja launched its first-ever own brand credit card, Jaja Vanta Credit Card.

In June 2019, Jaja welcomed Bank of Ireland UK and AA Credit Card customers onto its new credit card platform in October 2020, transferring historical Post Office Credit Cards to new Jaja Credit Cards.

Media Contacts:

Gabrielle O’Gara

Tel: 07818 240 343 / Email: press@jajafinance.com