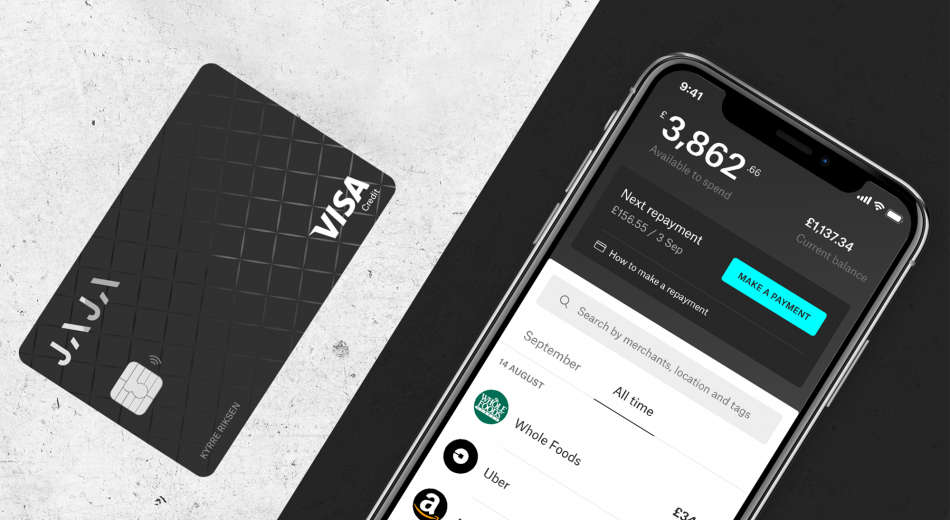

Jaja Finance and Bud sign new partnership deal to drive financial inclusion

- Bud to become Jaja’s Open Banking partner

- Partnership to offer wider access to credit and drive financial inclusion

- Jaja to use Bud’s Open Banking and data Intelligence capabilities to support with its affordability assessments

30 May 2023: Jaja Finance (Jaja), the digital lender, has signed a partnership deal with Bud Financial Limited (Bud), the Open Banking and data intelligence leader, to become its Open Banking partner. As part of the deal Bud will support Jaja with its affordability assessments within the credit card application process.

The partnership will open up greater access to credit and drive financial inclusion, by making credit available to those who might otherwise be declined using traditional decisioning methods, or those who are simply wishing to improve their credit score. The deal comes at a time when the pressures of the cost-of-living crisis continue to bite, and consumers are becoming more reliant on their credit providers to make the right lending decisions at the right time.

Incorporating Bud’s API solution, with its market-leading data aggregation and categorisation capabilities, will give Jaja greater insight into a customer’s financial profile, reducing the reliance on conventional practices while maintaining its sophisticated screening processes. The partnership will provide the digital credit card provider with a level of decisioning data that goes above and beyond the information available to credit rating agencies.

Lucas Dalglish, Chief Commercial Officer at Jaja Finance says: ‘Partnering with Bud means we can not only widen access to credit for UK consumers, and those that need it most, but we will also have the tools and functionality necessary to aid financial inclusion and ensure our customers’ financial health with real-time data.

“The partnership is part of our mission to becoming the UK’s leading digital lender. We believe our partnership with Bud will make a significant impact on giving people more access to credit and providing them with the tools they need to manage it well.”

Eloise Taysom, VP of Product at Bud says: “We’re thrilled to partner with Jaja Finance to support their mission of making credit simple. By leveraging our market-leading transactional data intelligence capabilities, we can help Jaja make more informed lending decisions that benefit consumers who might have been overlooked in the past.

“We’re excited to provide Jaja with our API solution for data categorisation and insight capabilities, which will offer real-time insight into customers’ financial profiles.

“This partnership represents a significant step forward in making credit more transparent and accessible to all.”

The partnership comes as Jaja continues to deliver on its accelerated growth plans following the launch of the Asda Money Credit Card and Asda Money Select Credit Card, a credit builder card aimed at those customers wishing to improve their credit score. This is yet another milestone in the digital credit card provider’s ambition of fueling its growth.

About Jaja Finance

Jaja Finance Ltd is a fintech providing digitally led credit card products with a focus on simplicity, functionality, service and security. It is headquartered in London and regulated by the FCA and combines the technical and digital capabilities of a modern technology business with deep retail financial services and credit card sector experience.

Following its closed transaction of up to £120 million with new majority shareholders – KKR and TDR Capital – in March 2022, Jaja Finance signed a partnership deal with Asda Money to provide digital reward credit cards to its 18 million customers.

Jaja welcomed Bank of Ireland UK and AA Credit Card customers onto its new credit card platform in October 2020, transferring historical Post Office Credit Cards to new Jaja Credit Cards.

About Bud Financial Limited

Bud Financial Limited (Bud) is a data intelligence platform which enables global companies to make financial decisions simpler by turning data into rich customer insights.

With over 2.5 billion transactions processed and 1 billion transactions enriched, Bud’s AI platform drives highly personalised experiences for lending and money management.

Founded in London in 2015, Bud’s aggregation, categorisation and AI capabilities power lending and supercharge affordability through income and employment verification, affordability assessments and ongoing transaction monitoring, connecting people to financial products and services that improve their lives.

Today, Bud has over 100 employees and offices in the United Kingdom and the United States.

Media contacts

Jaja Finance Press Office:

Gabrielle O’Gara

Tel: 07818 240 343 / Email: press@jajafinance.com

Bud Financial Limited Press Office

Imogen Thompson

Tel: 07900 070 500 / Email: budfinancial@babelpr.com