Jaja Finance Ltd announces closing of strategic transaction to deliver on its ambition of becoming the UK’s leading digital lender

-

KKR and TDR Capital LLP become majority shareholders in Jaja Finance Ltd with an initial investment of up to £120 million

-

Investment will drive innovative new customer offerings through first-class technology and decision systems

-

Jaja’s ambitious growth plans will see its team grow by 40% before the end of 2022

Jaja Finance Ltd (“Jaja”) today announces that it has closed the strategic transaction announced in November 2021, resulting in a consortium led by KKR and TDR Capital LLP becoming the majority shareholders of Jaja. The initial investment of up to £120 million marks the beginning of a long-term strategic partnership with its majority shareholders to support the digital lender’s ambitious growth plans over the coming years. Original investors, including IAG Silverstripe, retain significant holdings.

Jaja intends to use the initial investment to fuel its growth plans while driving the transformation of consumer credit. Its growth will be underpinned by a significant recruitment drive that will see a 40% uplift in its product and data science, software development, engineering and IT teams before the end of 2022.

David Chan, CEO at Jaja Finance, said, “Announcing the support of two leaders in the investment industry represents a considerable show of confidence in Jaja’s growth story, our plans and our people. Our new shareholders will bring valuable insights to the business and will help support our mission to offer best-in-class core technology, products and services, while delivering innovation that matters to customers.”

Credit funds and accounts managed by KKR first invested in Jaja in 2019 in conjunction with an acquisition of a UK credit card portfolio and have continued to invest in the business since.

Notes for Editors

About Jaja Finance

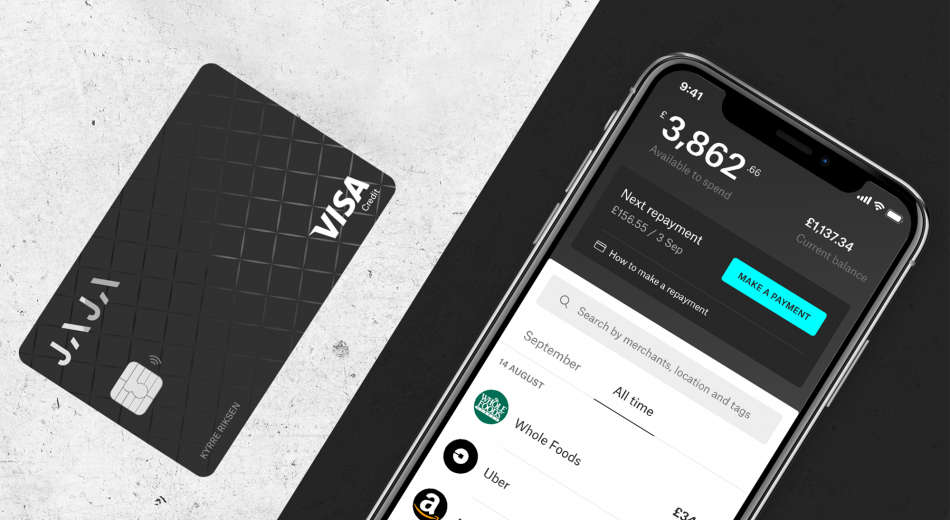

Jaja Finance Ltd is a fintech providing digitally-led credit card products with a focus on simplicity, functionality, service and security. It is headquartered in London and regulated by the FCA, and combines the technical and digital capabilities of a modern technology business with deep retail financial services and credit card sector experience.

As part of its long-term partnership with the Bank of Ireland signed in June 2019, Jaja welcomed Bank of Ireland UK and AA Credit Card customers onto its new credit card platform in October 2020, transferring historical Post Office Credit Cards to new Jaja Credit Cards.

About KKR

KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR’s insurance subsidiaries offer retirement, life and reinsurance products under the management of Global Atlantic Financial Group. References to KKR’s investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com and on Twitter @KKR_Co.

About TDR Capital LLP

TDR Capital LLP is a London-based private equity firm which manages investment funds with over €10 billion of committed capital. TDR seeks to invest in market-leading, European businesses and partner with them to develop and grow their operations.

Since its founding in 2002, TDR has been creating value by applying a high impact approach to a focused portfolio of companies. Portfolio companies of TDR include, among others: Arrow Global, Asda, David Lloyd Leisure, EG Group and Stonegate Pub Group.

Media Contacts

Gabrielle O’Gara

Tel: 07818 240 343 / Email: press@jajafinance.com